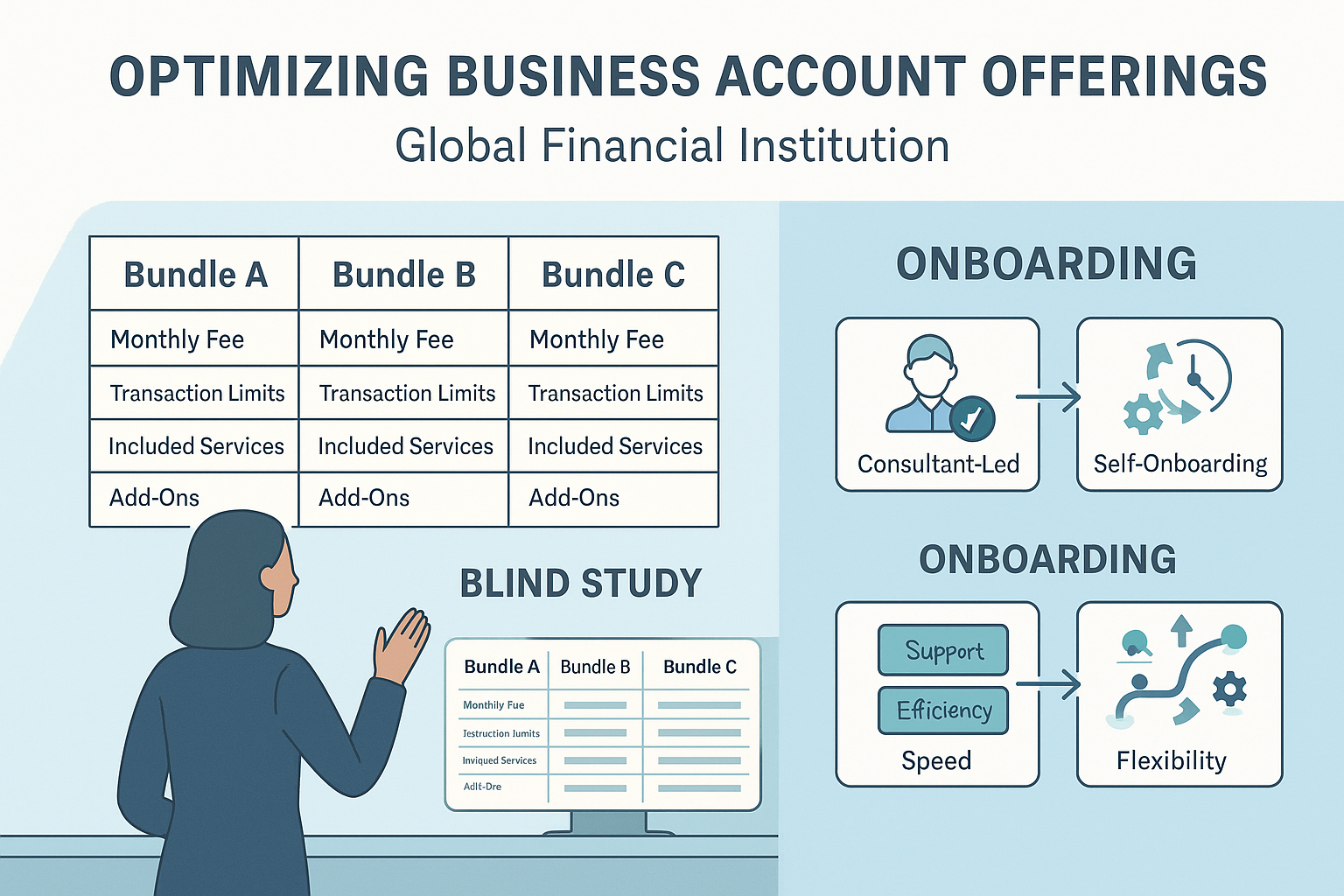

Optimizing Business Account offerings

Client: Global Leading Financial Institution

Project Type: Blind comparative study + onboarding experience evaluation

Brief

The client wanted to understand how corporate customers evaluate different business banking product bundles and whether onboarding style impacts their institution choice. The study compared bundles from three major financial institutions (blinded) and tested two onboarding approaches: traditional consultant-led setup and self-implementation.

Product Framing & Success Criteria

Product Goal: Optimize business banking account bundles and onboarding experience to increase adoption, satisfaction, and differentiation across corporate customer segments.

Primary Users: Small-to-large business owners, corporate finance decision-makers, and onboarding specialists supporting account setup.

Business Constraints: Highly competitive market, pricing sensitivity, varying customer sophistication, regulatory requirements, and cost of high-touch onboarding.

Success Metrics: Bundle selection preference, onboarding satisfaction, conversion intent, time-to-activate accounts, and pilot adoption outcomes.

Research Approach & Responsibilities

Study Design: Created a blind comparative framework to remove brand bias.

Recruitment: Targeted business owners and corporate decision-makers across varied industries.

Methods Used:

Warm-up interviews to capture current pain points and banking behaviors.

Card sorting of services into “Critical,” “Nice to Have,” and “Not Needed.”

Step-by-step review of bundle configurations, followed by side-by-side comparison.

Preference testing between onboarding models.

Facilitation: Moderated interviews ensuring neutral, unbiased probing.

Analysis: Synthesized qualitative feedback to identify patterns in bundle appeal, pricing perception, and onboarding expectations.

Key Insights

Bundle Appeal Drivers:

Businesses prioritized transaction flexibility over included add-ons.

Predictable monthly fees with higher limits were favored by mid-to-large corporations.

Onboarding Preferences:

Consultant-led onboarding seen as high-value for complex setups.

Self-onboarding appealed to smaller businesses for speed and control.

Brand Differentiation Opportunity:

Integrating hybrid onboarding (self-service + optional specialist) was seen as ideal.

Key Product Decisions & Tradeoffs

Feature-Rich Bundles vs. Pricing Transparency: Prioritized predictable pricing and transaction flexibility over bundled add-ons that added complexity without perceived value.

High-Touch Onboarding vs. Self-Service: Balanced operational cost and customer control by recommending a hybrid onboarding model rather than a one-size-fits-all approach.

Standardization vs. Segmentation: Supported tiered bundle offerings to address varying needs across business sizes while maintaining a manageable product portfolio.

Speed to Market vs. Insight Depth: Used blind comparative testing to rapidly surface decision drivers while avoiding brand bias that could skew bundle design.

Outcome

Informed client’s development of a new tiered business banking offering.

Led to pilot testing of a hybrid onboarding model.

Delivered comprehensive research findings to marketing and product development teams for bundle optimization.

Marketing research discussion guide showcasing research strategy.

Client: Global leading financial institution

Goal: To perform a blind study testing 3 different financial institution’s account packages aimed toward varying corporation sizes. Later, participants are introduced to two different onboarding options in an attempt to understand whether this initial phase of opening an account would affect a client’s decision in what financial institution they choose.

“Today we will be having a conversation about the most critical banking services for your needs and also evaluating a handful of potential product bundles so that I can have a better understanding of what is most/least useful to you.”

Warm Up

What is your current position?

Are there any current business banking pain points that you are currently trying to solve for?

How do you typically search for solutions/options?

Where do you look for that information?

Okay, we’re gonna kick off our first exercise which will be a list of services that you might like or need. I’m going to read them to you and i’d like you to tell me if you consider it Critical, Nice to have, or unnecessary. There’s about 20 of them and if you have any questions feel free to stop me and ask me to clarify.

Deep Dive

1. I’d like to start by getting a basic understanding of the types of products and services you consider critical for your business. I’m going to read you a list of items and I’d like you to tell me if the service is either Critical, Nice to have, or not needed.

***INTRODUCE FIRST CHART ***

Identifying the ideal bundle for you (Time check: Initiate this discussion no later than 30 minutes into the interview)

*********

Now that we’ve talked about specific needs you have, we’re going to take a look at a few different ways those products and services we just went over could be bundled in a single package for you.

They are from 3 different financial institutions, but we won’t be identifying which institutions. I’m going to the bundles one at a time because there is a lot of data to look at and after you’ve seen all three, I will show you them side by side to compare.

Let’s start with the first package

Which bundle would be the best fit for you? Could you tell me what about this bundle targets your specific needs?

What is the biggest impact a solution like this would have on your business? (So in what ways do you see a solution like this helping your team succeed)

-Are there aspects of each of the others that you like?

What aspects of each do you dislike?

Probes

Which method do you prefer for counting transactions- in example A where transactions are broken into many buckets OR example C where transactions are combined in a single bucket?

Do you prefer an “add-on” approach in example B versus A/C where the services are largely included? Or having the majority of your needed services included(or why not)?

For pricing the bundle monthly maintenance fee, do you prefer an “all inclusive” (higher monthly fee and higher transaction limits) approach or “pay as you go” (lower monthly fee and lower transaction limits)?

What about transaction limits for each, are they at the right levels? If not, what would work better for you?

Is the pricing in line with what you would expect to pay? (or why not?)

Onboarding:

Let's assume that you have selected the bundle that is the best fit for your needs. In a step-by-step process, tell me what you think would happen next to have all of the products and services set up for your business.

Probes:

What level of support do you think you would expect?

What aspects of getting set up would you expect to do yourself?

What aspects would make a great set-up experience for you?

What aspects would make a disappointing set-up experience for you?

How much time would you expect it to take end-to-end, from the time you selected the bundle to the time you were able to utilize all features and functionality?

Self Implementation

Now, I’m going to show you a description of a “self-onboarded” model and I’d like any feedback you have and what questions it raises for you?

“Be prepared to self implement.”

Implementation is automated to help you get up and running quickly. Instead of assigning an implementation consultant, we send you instructions and links to training resources. This means you can go at your own pace, at your convenience. “

Wrap up

What were aspects of things you reviewed today that would be really appealing to you?

How would you describe your ideal bundle to a friend?

What would definitely NOT be appealing to you?

Anything else you’d like to mention that you didn’t get a chance to?

Would you be interested in participating in future customer feedback sessions?